Contents

- Strong underlying current in price of the stock

- Candlesticks Patterns at a Glance

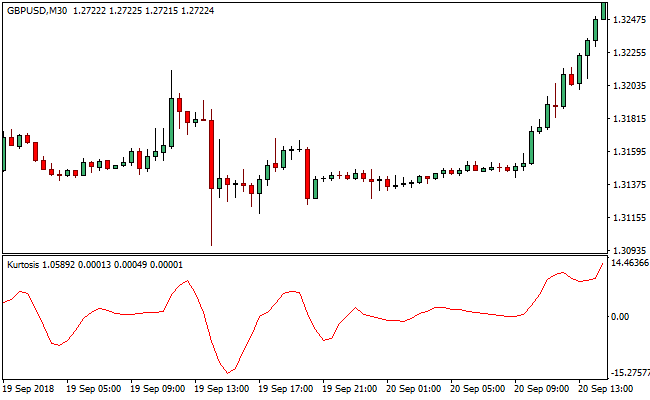

- Candlesticks as the only real time indicators with the signals that help you enter the markets at the right place right time.

- Formation of a small candle

- Harami Candlestick Patterns: Complete Overview, Types, Trade Setups

The bullish star pattern suggests that the bears are losing the momentum. A strong bullish candle followed after it indicates that bulls have gained the momentum. The three key factors needed for the morning star pattern are the three candle stocks establishing the movement from a downward trend to an upward trend. Like any technical analysis tool, the market star pattern also comes with its own set of pros and cons.

Also, they may need to assess the appearance of the pattern during the existing trend. This pattern is formed by three candles and is considered as an indication for a possible trend reversal in the market. Forex trading requires that the second candle is either bearish or doji. The third candlestick must be close to at least the top half of the first candlestick. It can be larger so as to engulf the previous two candlesticks or even more in the downtrend.

- Trading the financial markets carries a high level of risk and may not be suitable for all investors.

- Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

- In this situation, the trader might take a wrong entry at a much higher price level which would cause losses or very limited returns.

- Also, they may need to assess the appearance of the pattern during the existing trend.

The evening star is the pattern that stands in opposition to the morning star and denotes the transition from an uptrend to a downturn. If the long body green candle in morning star logs a high above the long red candle, the trend is indicating that the buyers are absorbing selling pressure emerging at higher levels. Similarly, the formation of Morning star pattern may have a “small red body” instead of a small green body. In such instances, the confirmation depends on the close of an immediate candle after the long body green candle. This candle needs to close aggressively on a positive note.

Strong underlying current in price of the stock

This candlestick pattern consists of three consecutive candlesticks. Usually formed at the bottom of a downtrend, this prominently visible pattern tells you there’s a new morning to come after the downtrend. The trader interprets this pattern and gets alerted to an imminent upward reversal of the stock price.

No worries for refund as the money remains in investor’s account. No worries for refund as the money remains in investor’s account.” Inferring morning start pattern will require some more understanding. The small gap on day 2 can be bearish, bullish or neutral. A neutral gap forms a morning Doji star, which is a variation of the morning star that represents indecision in the market.

Yes, no and the answers in between Are Indian banks out of the woods? Looking at the September-quarter results, one might be tempted to say the worst is behind for the India banking industry. Many banks have surpassed analysts’ profit estimates; even if a few have announced losses or smaller profits, that’s primarily on account of one-off deferred tax asset adjustments. Three government-owned banks and one owned by Life Insurance Corp continue to be in a bad shape. At least 10 public-sector banks are busy with their consolidation plans. The answer will have to wait, writes Tamal Bandyopadhyay.

Wherein, the stock is being expected to face a resistance initially at around the levels of 496.10, 505.80, and… The buyer of a future contract is required to acquire and/or receive the underlying asset prior to the contract’s expiration. When the futures contract is exercised, the seller of this contract has responsibility for providing and delivering the asset upon which it is based to the buyer. Want to learn more about technical analysis read more.. One should search for purchasing chances in the market as it is anticipated that the bullishness on P3 will likely remain for the upcoming trading sessions.

In addition to this pattern itself, the trader can also take clues from other technical indicators to identify the formation of a morning star pattern. The drawback of the morning star candlestick is that your stop loss for the trade becomes very deep due to gap ups. The decision to buy on the fourth day, after the confirmation, can give you a better entry level. However, the further gap up opening on fourth day may also result in missing the trade.

Candlesticks Patterns at a Glance

The morning star pattern, in conjunction with other technical measures, helps investors execute positive buying decisions for profitability as soon as a trend reversal takes place. Size assessments of the candlestick are an important determinant for reversal potential in the trend line. Of course, an evening star is the opposite of a morning star.

Some of the vital facts which a trader may make out from the formation of a morning star candlestick formation are price levels nearing a support zone. Morning star candlestick pattern forms after a significant price fall. You would need to see the fourth green candlestick of follow up buying as a confirmation signal of expected stock price rise. The third candlestick acts as a confirmation for the pattern formation as it is expected to close into the body of the first one. The pattern provides a strong confirmation signal for traders who may not wait to see the status of the fourth candle before investing in the stock. The traders are now confirmed about the candlestick pattern.

That is the point when the bears are unable to compete with the bulls. This causes the trend to reverse from a bearish downtrend to a bullish uptrend. This reversal is imminent but you need to be a little patient to see the overall pattern unfolding itself. Day 2 will most likely take care https://1investing.in/ of all of your doubts when the gap begins to take place from the bearish trend the previous day. The third candlestick is always bullish, marking the beginning of a turnaround of events and a sustained bullish trend. While the middle candle can be dark or light, its body size matters.

We at Enrich Money, do not promise any fixed/guaranteed/regular returns/ capital protection schemes. If anyone approaches you with such false information be informed spot rate formula that we do not allow that. We at Enrich Money do not provide any stock tips to our customers nor have we authorised anyone to trade on behalf of others.

The opposite pattern to a morning star is the evening star, which signals a reversal of an uptrend into a downtrend. The middle candle of the morning star captures a moment of market indecision where the bears begin to give way to bulls. The third candle confirms the reversal and can mark a new uptrend. This pattern can be plotted on the chart by adding it from the study menu in TradePoint & RZone. The pattern is also available in the system builder section.

It’s difficult to spot these candlestick patterns in a trending market. However, when the market is consolidating or highly volatile, such formations can ably assist in identifying trend reversals in advance. Stocks with such reversal patterns have seen a stable surge from a medium-term perspective. Herein, a long body green candle comes first, followed by a small red candle and the next is a long body red candle. This formation indicates that the selling pressure is growing stronger and the price is set to fall in the coming sessions.

Candlesticks as the only real time indicators with the signals that help you enter the markets at the right place right time.

The quantity at which the underlying asset is standardized to enable trading on a futures exchange is also specified in future contracts. Futures contracts are financial agreements that have a derivative aspect and provide for the exchange of an asset between the parties at a fixed future time and price. Futures Trading is the practice of trading using futures contracts. If the stock goes below the ‘low’ of the second candle, the ‘Morning Star’ formation is failed. You need to book your losses immediately and not wait for prices to bounce back.

But in many other cases, the pattern fails to give successful results. A small candle shows indecision on the part of the traders. This candle opens with a gap-up price, has a large body and ends in green, confirming the start of a new uptrend.

Formation of a small candle

Uncertainty exists with respect to the nature of selling in the market and the point at which it will level off. When there is indecision in the stock market space, a clear-cut signal is evident through the morning star pattern as it confirms the beginning of a bullish reversal. The morning star is a characteristic three-candlestick pattern with the middle one forming the star. The first large bearish candle is spotted on the first day of the morning star pattern.

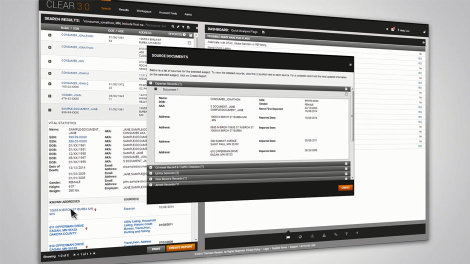

Harami Candlestick Patterns: Complete Overview, Types, Trade Setups

In morning star, one can see a gap up close and in Evening Star a gap down close. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. Do not trade in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. To ensure that our trading strategy is effective, it’s always recommended to mix and match the patterns and indicators.

Download ClearTax App to file returns from your mobile phone. You can buy the stock on the day of formation of third candlestick itself, just before the market close. After the ‘darkness’ of price fall ends, there is light, means prices are likely to rise in coming days. The name of this pattern is inspired from the planet Mercury in our solar system.